net investment income tax 2021 calculator

As an investor you may owe an additional 38 tax called net investment income tax NIIT. Take Home Salary Calculator India has been updated for the financial year 2020-2021 Take home salary calculator is also referred.

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. The net investment income tax calculator is for a person who has modified adjusted gross income more than the threshold and also investment income. Discover Helpful Information And Resources On Taxes From AARP. Single or head of household 200000.

Prepare federal and state income taxes online. We earlier published easy NIIT calculator. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases.

See What Credits and Deductions Apply to You. The threshold amounts are based on your filing status. Long-term capital gains are gains on assets you hold for more than one year.

Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad Enter Your Tax Information. You are charged 38 of the lesser of net investment.

Theyre taxed like regular income. The GST tax exemption amount which can be applied to. The Net Investment Income Tax NIIT is 38.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. E-File your tax return directly to the IRS. Interest dividends capital gains rental and royalty income and non-qualified annuities.

Net investment income tax 2021 calculator Saturday July 2 2022 The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or. For more information on the Net Investment Income Tax refer to Tax. As you know the net investment income of individuals estates and trusts is taxed at the rate of 38 provided they have income above.

For estates and trusts the 2021 threshold is. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

We are only required by the IRS to indicate annuity distributions. Taxpayers Net Investment Income is 90000. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

For tax years beginning on or before Dec. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. And is based on.

That means you pay the same tax rates you pay on federal income tax. The Net Investment Income Tax is based on the lesser of 70000 the amount that Taxpayers modified adjusted gross income exceeds the. For tax years beginning after Dec.

Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. We do not calculate the potential tax consequence. Review income tax deductions for income in Luxembourg.

The IRS gives you a pass. Income Tax Calculator in India helps determine the tax payable by individuals for the year 2020-21 considers tax rates levied as follows For individuals Hindu undivided families HUFs and. Married filing jointly or qualifying.

It is mainly intended for residents of the US. But youll only owe it if you have investment income and your modified adjusted gross income. The 38 Net Investment Income NII federal tax applies to individuals estates and trusts with modified adjusted gross income MAGI above applicable threshold.

Net investment income includes but is not limited to. This tax is also known as the net investment income tax NIIT.

2021 2022 Income Tax Calculator Canada Wowa Ca

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

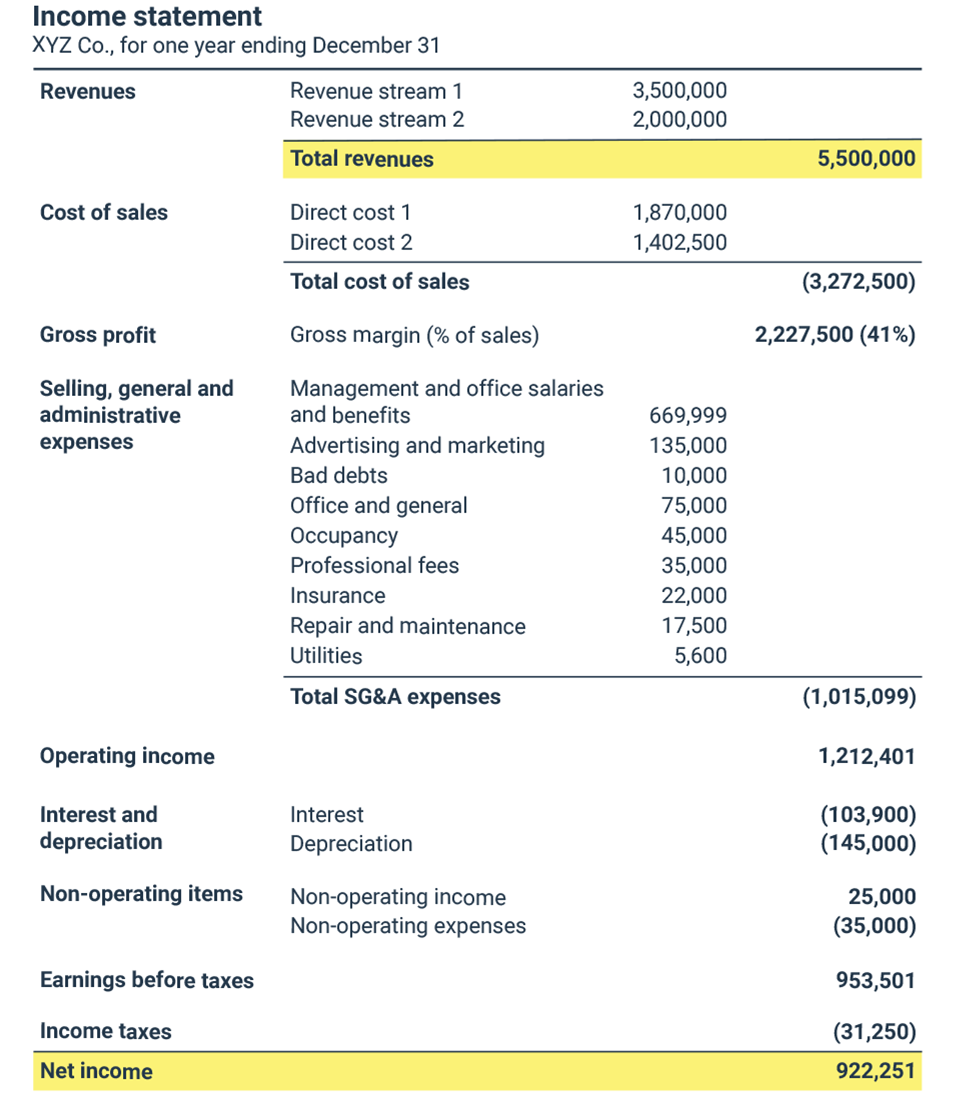

Net Operating Profit After Tax Calculator Efinancemanagement

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

Tax Calculator Estimate Your Income Tax For 2022 Free

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Capital Gains Tax Rates How To Calculate Them And Tips On How To Reduce What You Owe

Capital Gains Tax What Is It When Do You Pay It

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Net Profit Margin Calculator Bdc Ca

What Is The The Net Investment Income Tax Niit Forbes Advisor

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

How To Calculate Additional Medicare Tax Properly

Canada Capital Gains Tax Calculator 2022

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

![]()

How To Save Taxes For The Self Employed In Canada Filing Taxes

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)